Flex

Did you know it's possible to use your HSA or FSA account to pay for doula support (usually)?! Exciting, right?

I don't understand why insurance doesn't cover doula support when insurance companies would save a boatload of money with the numerous benefits like reductions in cesareans and better maternal and neonatal outcomes (especially when our country far exceeds all other developed countries in maternal mortality rates, and that, friends, is a soapbox I will climb on another day).

Anyway, if your doctor agrees that you have a medical condition of pregnancy and childbirth, you may be eligible! (Again, please step over my soapboxes labeled "the tragical disservice of treating all pregnancies and births as pathological conditions rather than physiological phenomena....")

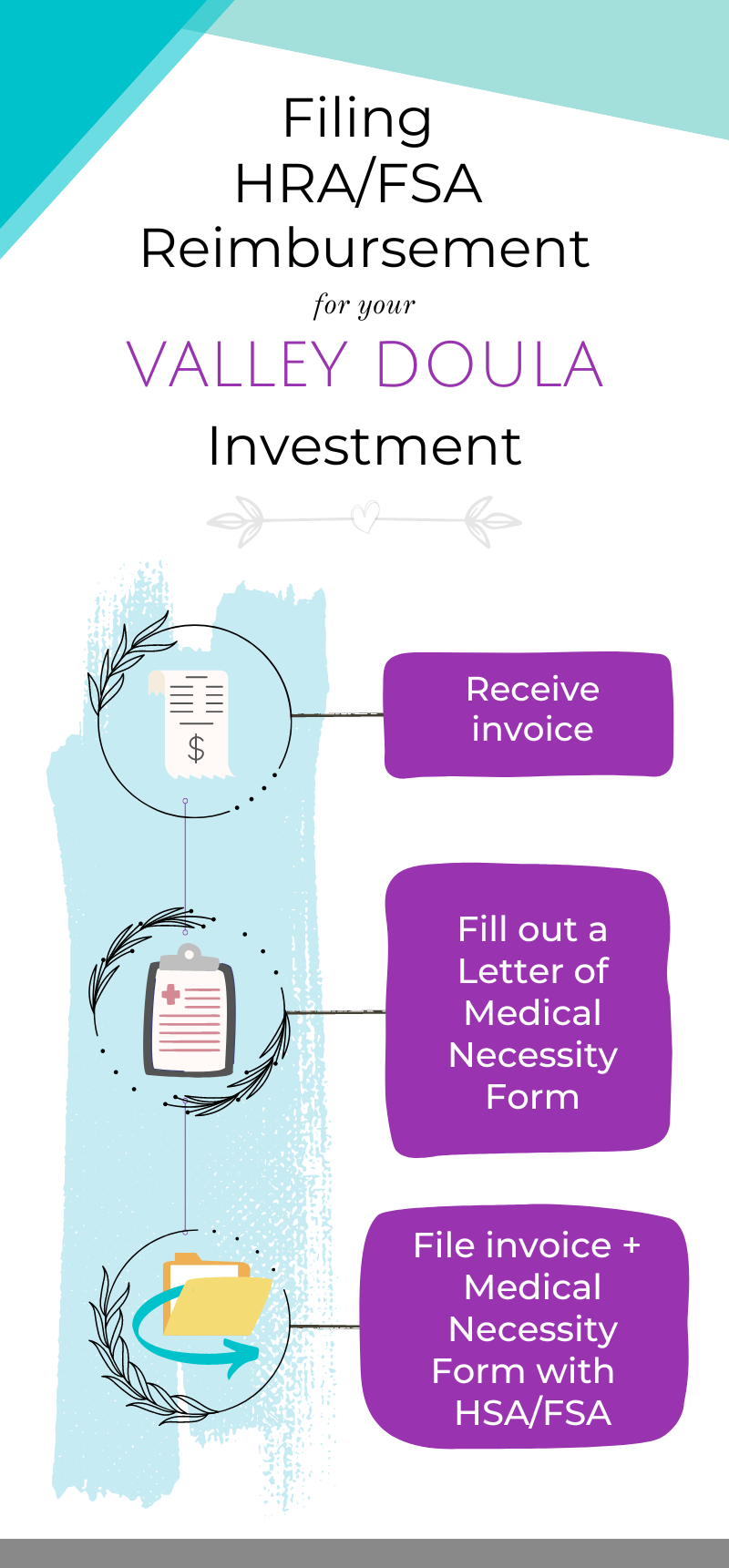

I made you a pretty infographic, because that's a thing I like to do, but it's just 3 steps!

Filing HSA/FSA Reimbursement for Your Valley Doula Investment

- Receive your invoice and pay your fee to The Valley Doula.

- Fill out a Letter of Medical Necessity Form (either directly from your H/FSA, or by using a generic one found online.) Your provider will need to complete the form affirming you have the medical condition of pregnancy and the recommended treatment is "doula support."

- File your invoice and Letter of Medical Necessity form with your HSA/FSA (typically can be done online). As with all H/FSA filings, hold onto your paperwork in case you are audited.

Last step: Enjoy your reimbursed investment in high-quality doula support!

Comments

Post a Comment